EBANX, an acclaimed Brazilian cross-border commerce platform, has recently bagged US$430 million from investors worldwide, proving the platform’s success and potential in the competitive global market.

The funding came ahead of the platform’s upcoming public offering, sure to open up greater opportunities for its growth. This article will explore the latest news on EBANX and analyse how the company has garnered such substantial funding ahead of its IPO.

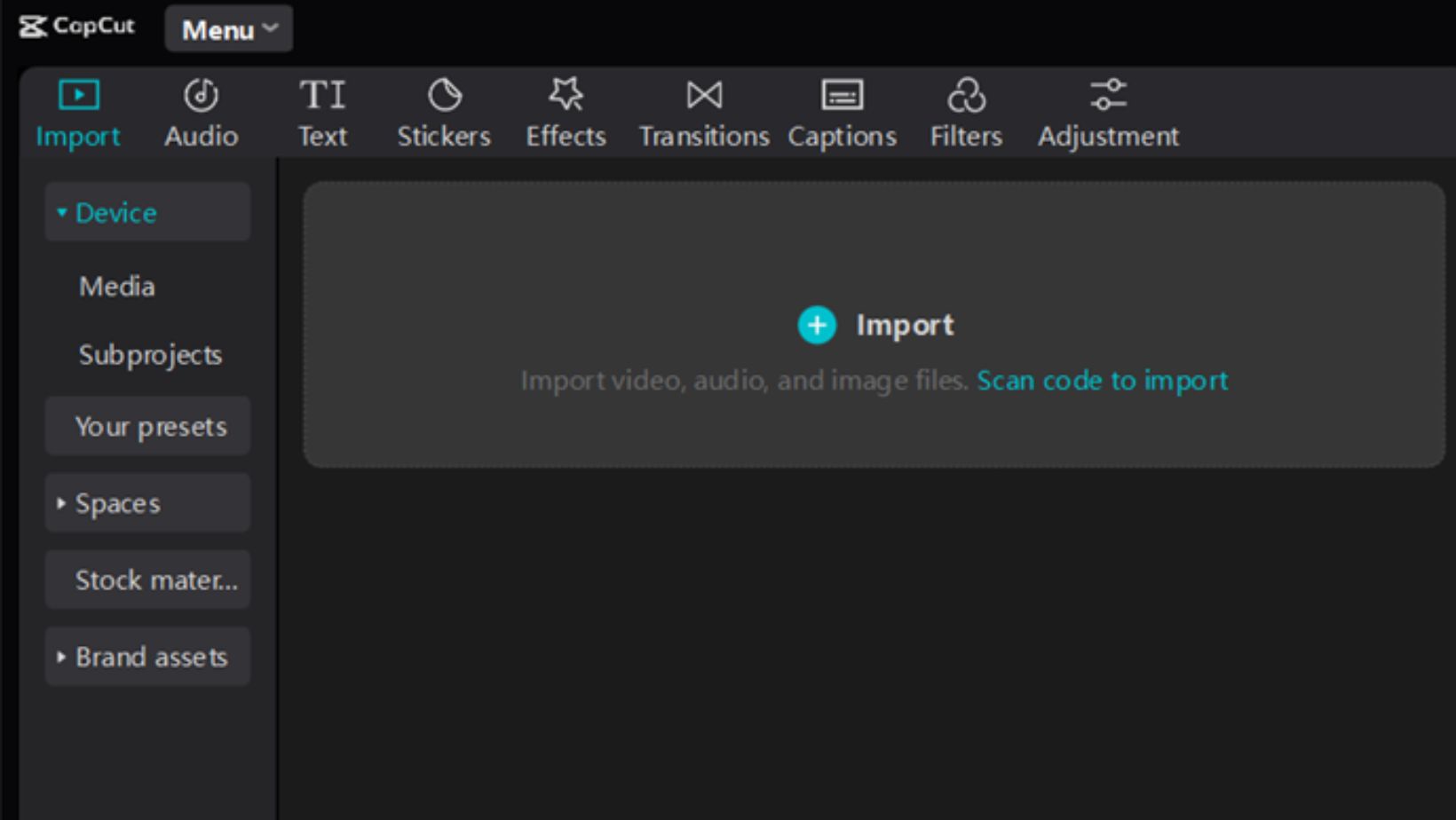

Overview of EBANX

EBANX is a Brazilian fintech company that provides payment solutions to merchants worldwide. Established in 2012, EBANX has already processed over $10 billion in payments and serves over 17 million active consumers in Latin America. Their real-time communications platform allows merchants to deliver fast, localised payment experiences that customers expect when shopping online.

EBANX also offers merchant services such as merchant onboarding, merchant accounts, card processing services, fraud management systems and more. These services are designed to help merchants quickly adopt digital payments and serve the new generation of digital consumers.

Recently, the firm closed a Series D investment round which secured an additional US$430 million from investors such as GP Investments Ltd., Gávea Investimentos Ltda., Goldman Sachs Private Capital Investing (PCI), QED Investors and Verde Asset Management, among others. This is EBANX’s largest financing round and brings the total amount of funding raised since its founding to US$770 million, valuing the company at US$4 Billion.

With this new capital injection, EBANX will be able to fuel growth while setting the stage for an initial public offering (IPO) over the coming years. In addition, the new funds will be invested in accelerating international expansion into countries such as Germany, Portugal and Italy; increasing innovation by investing in technology and product development; developing its operations infrastructure in Latin America; and forging strategic partnerships with leading companies worldwide.

EBANX’s Financing Round

Brazilian Cross-Border Commerce Platform EBANX recently announced a US$430 million financing round ahead of their initial public offering. This investment, led by Softbank and Tiger Global Management, has set a new record for the Brazilian startup scene. It will provide EBANX with the necessary capital to expand into foreign markets.

Let’s take a closer look at this impressive financing round.

Overview of the Financing Round

In its latest financing round, Latin American fintech firm EBANX raised US$430 million, valuing the company at US$3.5 billion ahead of a planned IPO.

Led by DST Global, the financing round included existing investors such as Accel, Goldman Sachs and TCV, as well as new strategic investor BSP International Investments Ltd, the largest enterprise of China-based Blue Focus Group. The new round increases EBANX’s total amount raised to date to more than US$600 million.

EBANX serves more than 3 million customers in Latin America through its range of global payment solutions for merchants and consumers across Mexico, Brazil and Colombia. In addition to providing global payment solutions for Brazilian customers by leveraging open banking protocols for real-time payments, EBANX is also covering everyday needs of over one million Mexicans and Colombians by deploying a wide range of localised digital assets.

By using its unique geographical footprint approach in expanding access to global payments and e-commerce opportunities in Latin America while observing local regulatory frameworks across different countries, EBANX has fostered economic development in emerging markets throughout Latin America and is committed to driving further progress through its upcoming public listing.

Details of the Financing Round

The Brazilian fintech EBANX has closed a financing round totaling US$430 million led by a consortium of investors, which include DST Global, SoftBank’s Vision Fund 2, Ribbit Capital and Singapore’s Temasek. This marks one of the largest private funding rounds in Latin America and the latest sign of the rapid growth in recent years from EBANX.

EBANX is an integrated platform that provides merchant cross-border fintech solutions, payment processing and banking services to help companies to expand their international ecommerce operations. The company links local payment options to merchants in 17 Latin American countries, including virtual wallets. In Brazil alone, it serves 32 different payment methods across 12 counties.

In addition to the funding round, EBANX also announced its intention to go public through an initial public offering (IPO) on a yet-to-be-determined U.S.-based stock exchange. This move will further position EBANX as a Latin America digital economy leader. Furthermore, it will open up opportunities for other tech companies throughout Brazil and Latin America more broadly through increased exposure on global capital markets. In addition, the move demonstrates how leading fintech companies can raise substantial sums outside traditional venture capitalist backers for early stage investment capital rounds.

This financing round marks a milestone for EBANX as one of Latin America’s most successful startups. It will help fuel their continued growth as they set their sights on going public with an IPO.

Brazilian Cross-Border Commerce Platform EBANX Bags US$430 Million Ahead of IPO

Brazilian cross-border commerce platform EBANX secured US$430 million in a recent funding round, ahead of its anticipated initial public offering (IPO).

This financing round provides a major boost for the Latin American digital payment provider, as it prepares for its first step to a successful IPO.

This article will explore the potential impact of this financing round on EBANX and the financial markets.

EBANX’s Expansion Plans

EBANX’s new funding is expected to drive international expansion and fuel the fintech’s rapid growth, enabling it to broaden product offerings and geographical reach. The company will use the new capital to reinforce operations in markets such as Brazil, Mexico, Argentina and Columbia. This is also an important milestone for EBANX’s next steps into the US market, introducing products in the retail payments area ranging from secured cards to cross-border digital banking solutions.

The company will also use this round to further invest in technology teams worldwide while launching a new B2B unit targeting small businesses in Latin America offering supply procurement solutions. In addition, EBANX plans to invest heavily in customer experience teams and artificial intelligence (AI).

EBANX plans to help its clients reduce costs by automating processes such as data classification with machine learning algorithms. Ultimately, this could further enhance the customer onboarding process by validating documents through AI scanning platforms.

EBANX’s Positioning Ahead of IPO

EBANX, Latin American’s leading payment technology company, announced on January 26th that it had raised US$430 million in its latest financing round. Softbank-backed Discovery Americas and other VCs such as GP Investments and Accel led the financial injection. This substantial funding round bolsters EBANX’s position as a global payments leader ahead of its 2021 IPO.

The new financing round surpasses the company’s previous rounds of capitalization and firmly positions EBANX as a fully-digitalized leader in the financial technology space across Latin America and Asia-Pacific. EBANX has grown from providing innovative payments solutions to over 200 companies from 30 countries to a mission to become an end-to-end ‘financial platform for the region’s underserved population’ with more than 65 million users accessing their services today.

This significant investment is intended to drive further growth into markets such as Mexico, Brazil and India; accelerate new product development; accelerate innovation; strengthen its data analytics platforms; expand opportunities to ease access of financing for SMEs throughout Latin America – ultimately cementing its position within the global market ahead of its upcoming IPO later this year. As a result of this positioning, EBANX is positioned to become a major player in the FinTech startup ecosystem over the coming years with more innovations to come.