Innovation and advanced technologies are all created and developed for the sake of making profits. So don’t be surprised that fintech is one of the fastest-growing industries, attracting the best specialists and investing huge resources in new-level software development. One step ahead of its counterparts is always Forex Trading Corporation. Major players and brokerage companies are successfully using revolutionary solutions and technologies to create the best digital products for trading and earning high profits. So what are the key software developments that are already available to users and form the basis of the current Forex Trading Market?

Trading Platforms: High Productivity Fintech Software

Automated Trading Systems (ATS) formed the foundation of modern Forex processes. This is a large-scale software that covers the processes and mechanisms of transactions at all levels. To experience how it works, all you need to do is metatrader 4 download. This is the most popular, basic, simple, and understandable trading system for almost every user. MT4 platform and its more complex next version MT5, not only give traders access to markets and exchanges but also fully show data, collect and analyze them. It is reasonable that having mastered such a powerful functionality, traders and brokers will become more efficient, using 100% of the privileges of digital technologies for financial operations.

Algo Trading – Advantage of Latest Generation Software

Forex software has several modes. Their main feature is the automated mode of algorithmic trading. Unlike manual options, the algo trading system uses complex mathematical models and algorithms to make the most profitable trades 24/7.

Certainly, setting up such an automated system will require the trader to have a deep knowledge of currency buying processes, but in the long run, it will provide privileges:

➔ avoiding the risks of the emotional factor of making deals;

➔ optimization of the most successful trading strategies;

➔ control of multiple processes at the same time;

➔ saving personal time without the need to be always online;

➔ higher profits by constantly improving the results of trades.

Analytics ToolKits for Successful Deal Results

Big data analytics technologies are more important in the financial industry than anywhere else. The mission of next-generation advanced software is automated machine learning based on detailed calculations and analysis. Integration of these tools into Forex Trading platforms is a must because the process of predicting market swings and optimizing working strategies is the most effective way to improve skills and results.

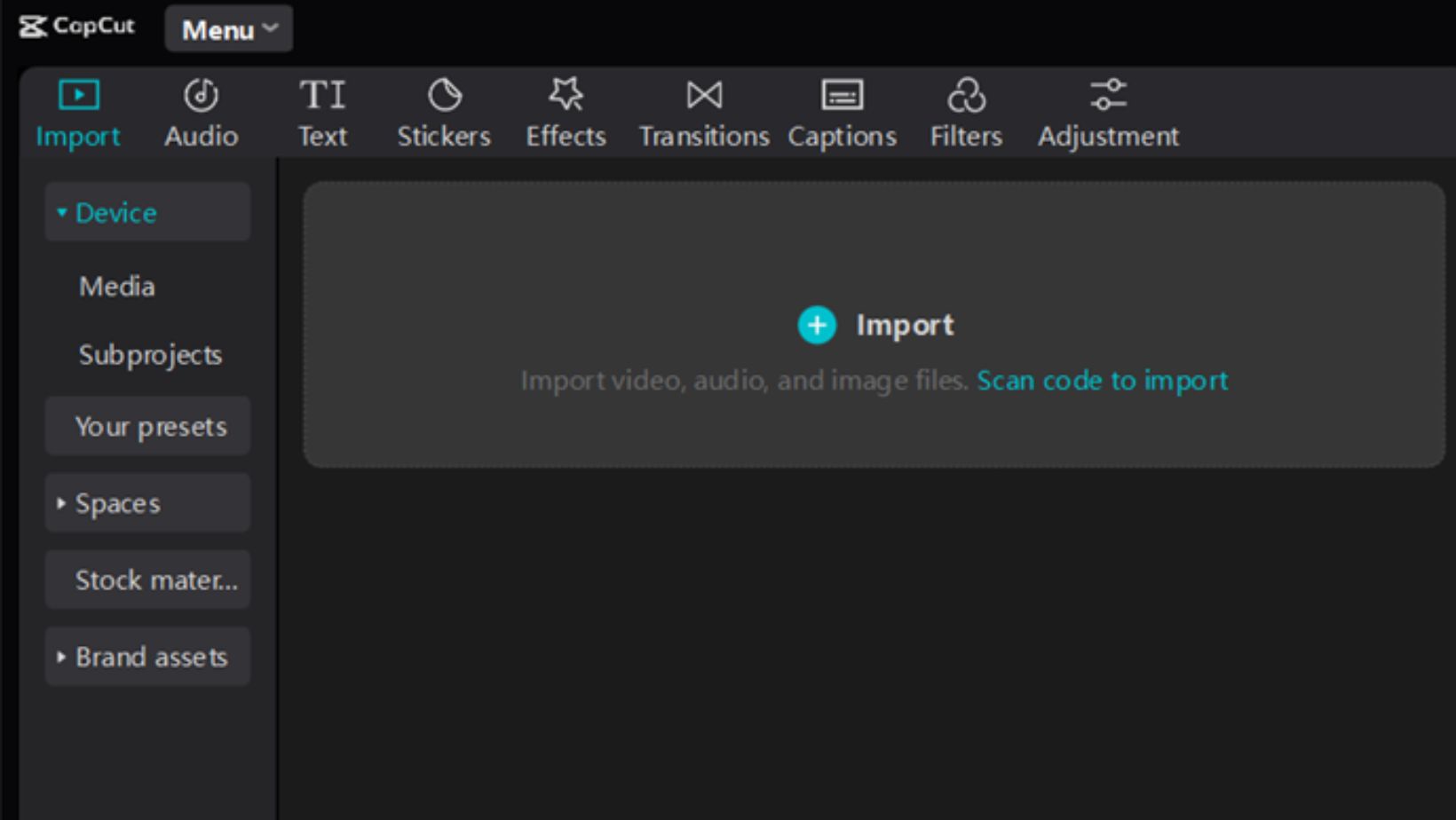

Mobile Apps Implementation for Forex Trading

Another significant direction in the fintech industry is the development and transformation of software for mobile devices. It is this format of interaction between Forex exchanges, brokers and dealers that is currently identified by experts as the most promising. The trend towards fast real-time transactions from any location forces companies to adapt their trading platforms without losing functionality.

Today, MetaTrader 4 and 5 versions have some of the best apps for Android and Apple OS on the market, and they are used by millions of traders around the world.

Trading Process Simulators as an Important Part of Learning Fintechs

Forex, as one of the most stable Exchange Markets, pays a lot of attention to creating a supportive community and educational atmosphere for traders. So many tutorial resources and trading academies are free and available to everyone. And, of course, new learning portals are appearing more and more frequently. Special transaction simulators are built into the software, where beginners can not only study the processes but also experiment and try their skills in Forex trading without the risk of losing the real budget. In the training mode, students have access to almost all options, which greatly increases the positive practice effect.

Conclusions

The Forex trading universe is always in the process of transformation. Innovative developments and technologies that are being introduced into the financial environment have a direct impact on this. Analog mechanisms have been replaced by digital automated processes of deals and transactions, which are made possible thanks to productive software. Trading platforms have a wide range of functionalities that provide the best level of interaction for all players of the Forex Market and give traders effective tools to improve the efficiency of trading and reach a much higher level of earnings.